-

Massive Resignations Have Started

Massive Resignations Have Started

Massive Resignations Have Started

This entry was posted on February 21, 2012, in Economy, Politics and tagged Institute for Works of Religion, National Catholic Reporter, Pope Benedict XVI, United States Treasury security, World Bank.

Posted by eClinik on February 21, 2012 in Solutions

Recently, the WhiteHats released this video of Lord James of BlackHeath urging the House of Lords to conduct an investigation related to a possible bank heist to the tune of US$ 16 Trillion. This is a very significant measure as it is now put on public record those "wild rumors" being passed around in the alternative media. The White Dragon Society represented by Ben Fulford is also confirming that a March 31st deadline has been set by the Gnostic Illuminati against the Khazarian Satanic Cabal to transfer power over to Prince Harry to effect Global Settlements. To our understanding this amount is separate from the US$16 Trillion being doled out since Obummer was put into office.

There are significant resignations made by CEOs and other high-ranking officials across the globe. Are we now witnessing the downfall of the Dark Cabal?

World Bank President Zoellick Resigns

( WASHINGTON ) - World Bank President Robert Zoellick said Wednesday he is stepping down, raising the possibility that a non-American might be chosen for the first time to head the 187-nation lending organization.

( WASHINGTON ) - World Bank President Robert Zoellick said Wednesday he is stepping down, raising the possibility that a non-American might be chosen for the first time to head the 187-nation lending organization.

Zoellick, 58, informed the board he will leave June 30 at the end of a five-year term, during which he led the bank's response to the global financial crisis.

The board now begins looking for a new president under guidelines directors adopted in 2011 calling for an "open, merit-based and transparent selection" process.

Read more: http://business.time.com/2012/02/15/world-bank-president-zoellick-resigns/#ixzz1mxj9hBYg

Arrests made in Italy after discovery of $6 trillion in fake U.S. bonds

(CNN) - Italian authorities on Friday arrested eight people in possession of an estimated $6 trillion in counterfeit U.S. Treasury bonds, according to Italian paramilitary police and an Italian news agency.

The discovery of the fake bonds - made to look as if they were printed by the U.S. Federal Reserve in 1934 - came about as part of an investigation into a local mafia association.

The arrest order for the alleged criminals was issued by a preliminary investigative judge in the southern Italian city of Potenza , police noted.

Italian authorities, working with their Swiss counterparts, learned about the counterfeit bonds by way of eavesdropping on wiretapped phones, police said.

The total of $6 trillion is more than twice the Italy 's national debt.

read more: http://edition.cnn.com/2012/02/17/world/europe/italy-counterfeit-bonds/index.html?hpt=hp_t3

Four Priests Charged In Vatican Banking Scandal

Italian investigators have charged four priests with laundering money out of the Vatican 's official bank, the Institute for the Works of Religion, the National Catholic Reporter's John L. Allen Jr. writes.

The Italian daily l'Unita was the first to report that the priests were being investigated for laundering hundreds of thousands of dollars.

It's the latest in a series of investigations into Vatican finances dating back to 2010. In December of that year, Pope Benedict XVI decreed an updated anti-money laundering law for Vatican finances.

Read more: http://articles.businessinsider.com/2012-02-09/europe/31040509_1_anti-money-laundering-law-vatican-finances-italian-tv#ixzz1mzWufb4S

CFO of ANZ Bank Resigns Amid Turmoil

February 16, 2012 | 3:26 am

The chief financial officer of Australia & New Zealand Banking Group Ltd. announced recently that he will resign from the position, a move that will reportedly lead to a significant executive shuffle.

According to MarketWatch, CFO Peter Marriott says he plans to pursue a non-executive career after spending 15 years as the bank's finance chief. Marriott will officially leave the financial institution on May 1, at which time institutional banking head Shayne Elliott will reportedly take over the role.

This move will lead to a number of other changes, as the bank's head of Asian operations will take on a larger role to include global institutional banking, while a new chief executive for global wealth management and private banking will also be named.

read more: http://www.proformative.com/news/1470243/cfo-anz-bank-resigns-amid-turmoil

Nicaragua Central Bank Head Quits Amid Row

By Adam Williams and Blake Schmidt - Feb 15, 2012 3:25 AM GMT+0800

Nicaragua's Central Bank President Antenor Rosales quit amid differences with President Daniel Ortega over plans to use central bank reserves for the creation of a regional bank for a Venezuelan-led bloc of Latin American nations, known as Alba.

Ortega has proposed that Finance Minister Alberto Guevara replace Rosales as head of the central bank, said Edwin Castro, the chief legislator for the ruling Sandinista party, in a statement on a government website today. Castro said the appointment must be approved by lawmakers and didn't say whether Guevara would continue at the Finance Ministry.

Castro said Rosales's resignation was "normal government procedure" and not a result of the disagreement with Ortega.

In a Feb. 4 meeting of Alba leaders in Caracas , Ortega agreed to put 1 percent of Nicaragua 's international reserves, or about $17 million, toward the Alba bank, according to a statement on a government website. Rosales told reporters in Managua on Feb. 6 that "no one can touch the international reserves of Nicaragua ."

"The resignation of Rosales sends a bad message to the people of Nicaragua," opposition legislator Wilfredo Navarro said in comments at the National Assembly broadcast on TV Channel 100% Noticias. "He was defending the legality of the country's central bank institution. Withdrawing funds for an unknown bank is a violation of the institution."

read more: http://www.bloomberg.com/news/2012-02-14/nicaragua-central-bank-head-quits-amid-row.html

Switzerland's central bank chief resigns

Swiss National Bank Chairman Philipp Hildebrand arrives in front of the Swiss National Bank building for a news conference in Bern January 9, 2012. Hildebrand resigned with immediate effect on Monday, relinquishing one of the world's top 10 central banking jobs because he has been unable to prove he was unaware of a $418,000 currency trade made by his wife.

Swiss National Bank Chairman Philipp Hildebrand arrives in front of the Swiss National Bank building for a news conference in Bern January 9, 2012. Hildebrand resigned with immediate effect on Monday, relinquishing one of the world's top 10 central banking jobs because he has been unable to prove he was unaware of a $418,000 currency trade made by his wife.

Philipp Hildebrand defends his achievements at financial institution as he bows to uproar over private currency deals.

The Swiss National Bank chairman has resigned abruptly, bowing to a public uproar over his private currency deals.

Philipp Hildebrand's decision comes just as a Swiss parliamentary committee is preparing to grill him behind closed doors.

His resignation took effect immediately on Monday, Switzerland 's central bank said in a brief statement.

A short time later, Hildebrand called an impromputu press conference in the Swiss capital of Bern , where he emphasised that he was proud of his achievements at financial institutions in Switzerland and international organisations such as the World Bank.

"I would like to think I have been a damn good central banker," Hildebrand said.

read more: http://www.aljazeera.com/news/europe/2012/01/201219145612935171.html

Credit Suisse's Private Bank Chief Asian Economist Tan Resigns

February 20, 2012, 1:17 AM EST

By Jonathan Burgos

Feb. 17 (Bloomberg) - Joseph Tan, chief Asian economist of Credit Suisse Group AG's private bank in Singapore has resigned.

"I have left Credit Suisse," Tan, who joined the Swiss bank in September 2008, said. "I'm considering my options at the moment."

Tan previously worked at Fortis Bank SA and Standard Chartered Plc. Credit Suisse spokeswoman Juliette Leong confirmed his departure in an e-mail. Today was his last day, she said.

source: http://www.businessweek.com/news/201...n-resigns.html

Embarrassment for Merkel as German president resigns in disgrace after trying to bag the press

- President Christian Wulff is though to be about to leave his office amid an escalating scandal

- He is alleged to have accepted free holidays from wealthy friends, upgrades on airlines and discounted cars

By Allan Hall and David Williams

Last updated at 1:57 AM on 18th February 2012

Germany 's president resigned in disgrace yesterday after failing to gag newspapers investigating him over political favours.

The resignation of Christian Wulff - a victory for Press freedom - is an embarrassing blow to Chancellor Angela Merkel, who had hand-picked her political ally as president.

In a curt statement at the presidential palace in Berlin , Mr Wulff said he had lost the trust of the German people, making it impossible to continue in a role meant to serve as a moral compass for the nation.

He was forced to resign after trying to stop German newspapers investigating a home loan scandal involving more than £430,000 received from a businessman friend's wife - allegations taken up by prosecutors.

Mr Wulff, 52, whose role was mainly ceremonial, admitted making a 'grave mistake' by leaving a message on the answering machine of the editor of Germany's best-selling Bild newspaper threatening 'war' if the daily published a story about his private finance dealings.

Read more: http://www.dailymail.co.uk/news/article-2102524/German-President-Christian-Wulff-forced-resign.html#ixzz1mxlESriQ

Berlusconi could get five years

Italian prosecutors have demanded a five-year prison sentence for former premier Silvio Berlusconi in his trial on corruption charges.

Prosecutor Fabio De Pasquale urged the court to find Mr Berlusconi guilty of having paid a British lawyer 600,000 dollars (£382,000) to lie in other trials involving charges of tax evasion and false accounting related to the billionaire media mogul's business dealings.

Prosecutor Fabio De Pasquale urged the court to find Mr Berlusconi guilty of having paid a British lawyer 600,000 dollars (£382,000) to lie in other trials involving charges of tax evasion and false accounting related to the billionaire media mogul's business dealings.

The court is racing toward a verdict before the charges expire due to the statute of limitations. Mr De Pasquale calculated that would happen by mid-July.

This is one of several cases pending against Mr Berlusconi in Milan courts, including a trial on charges of having paid for sex with an underage prostitute.

He stepped down in November after failing to persuade investors he could revive the ailing economy.

source: http://www.independent.ie/breaking-news/world-news/berlusconi-could-get-five-years-3021249.html

Blankfein out as Goldman Sachs CEO by summer?

Exclusive: Goldman Sachs prepares for life after Lloyd Blankfein, and Gary Cohn is the leading candidate to succeed him as CEO.

Gary Cohn, right, is next in line to replace Lloyd Blankfein, left

Gary Cohn, right, is next in line to replace Lloyd Blankfein, left

FORTUNE - Lloyd Blankfein may step down as chief executive of Goldman Sachs as early as this summer; and president and chief operating officer Gary Cohn is the lead candidate to replace him, according to a Goldman executive and a source close to the firm.

A Goldman spokesman declined to comment.

To be sure, anything can happen over the course of the next few months and the departure of Blankfein, 57, is not certain. It is still up in the air whether Blankfein wants to step down. It would also not be unheard of for Blankfein to share the role of CEO, as so many others at Goldman have in the past. Former co-heads include John Weinberg and John Whitehead; Robert Rubin and Stephen Friedman; and Jon Corzine and Henry Paulson.

But corporate governance experts have emphasized that leadership changes at the nation's largest financial institutions go a long way toward helping those firms move past the troubles - particularly the reputational damages - wrought by the financial crisis. The feisty Blankfein, the son of a postal worker who grew up in Brooklyn , is one of the only big bank CEOs to have kept his job after the financial crisis. The other is Jamie Dimon, CEO of JPMorgan Chase (JPM).

read more: http://finance.fortune.cnn.com/2012/02/17/gary-cohn-goldman-sachs/?iid=Popular

Bank feud: Chairman Giles quits VNB with other directors

A feud over corporate governance compounded an already painful December for a major Central Virginia financial institution. Virginia National Bank has experienced a leadership shake-up that has seen nearly one third of the board of trustees quit including the chairman, Mark Giles.

"My resignation is effective immediately," Giles tells President Glenn Rust in a December 19 letter that followed an apparently contentious meeting earlier that day. Neither Rust nor Giles, who spent nearly a decade as the Bank's first president and who chaired the board since 2005, returned repeated telephone messages.

Two other board members, Ms. Claire Gargalli and Mr. Leslie Disharoon, also quit that same Monday in what the bank concedes was a disagreement over the composition of its board of directors. A fourth director on the 13-person board, Neal Kassell, resigned two days later for unstated reasons.

read more: http://www.readthehook.com/102524/bank-feud-chairman-giles-quits-vnb-other-directors

Arrests in Olympus Scandal Point to Widening Inquiry Into a Cover-Up

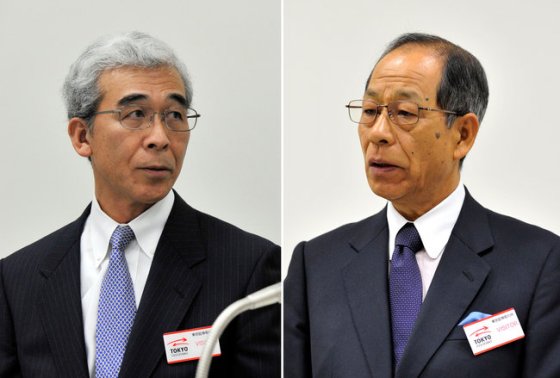

Hisashi Mori, the former executive vice president of Olympus , left, and Tsuyoshi Kikukawa, a former chairman and president, were among those arrested

Hisashi Mori, the former executive vice president of Olympus , left, and Tsuyoshi Kikukawa, a former chairman and president, were among those arrested

TOKYO - Arrests of seven people Thursday accused of involvement in the $1.7 billion accounting scandal at Olympus, including the company's former chairman and executive vice president, point to a widening investigation into a cover-up ostensibly carried out by top management with the help of a group of former bankers.

Tsuyoshi Kikukawa, who was the company's chairman until the scandal broke last fall, was arrested in Tokyo as were two other former executives on suspicion of having falsified financial statements, Tokyo prosecutors said. Two former Nomura investment bankers who had been previously mentioned by investigators were also taken into custody, accused of violating securities laws, and so were two of the bankers' associates.

By aiming a spotlight on what critics say is Japan's lax corporate governance, and casting a shadow over one of the country's former blue-chip companies, the Olympus scandal has become a test of how far Japan is willing to go to fight white-collar crime.

read more: http://www.nytimes.com/2012/02/17/business/global/7-arrested-in-olympus-accounting-cover-up.html?_r=3

Korea Exchange Bank chief steps down

SEOUL, Feb. 10 (Yonhap) - The head of South Korea 's No. 5 lender Korea Exchange Bank (KEB) stepped down after completing his three-year term on Friday, and handing over to his successor, the role of completing the deal to sell the bank to a local counterpart.

Larry Klane, the president of KEB, expressed gratitude to his staff at a farewell ceremony held in central Seoul , for embracing a foreign chief "who's not used to the country," adding he did his best to draw a brighter future for the KEB in the midst of financial difficulties.

source: http://english.yonhapnews.co.kr/business/2012/02/10/0503000000AEN20120210005100320.HTML

Head of Russian bank regulator steps down

The head of supervision at Russia 's central bank has resigned after a series of scandals in which regulators failed to detect massive mismanagement in some of Russia 's largest banks. Gennady Melikyan, deputy governor of the central bank in charge of bank supervision, announced he would step down on Sept. 9. He occupied one of the most hazardous jobs in the Russian financial sector - his predecessor Andrei Kozlov was shot dead in 2006 in an assassination-style hit after launching a crusade to.

read more: http://newsley.com/articles/head-of-russian-bank-regulator-steps-down/206711

AJK Bank's executive steps down

MIRPUR (AJK) - Zulfiqar Abbasi, Member Board of Directors & Member Audit Committee of The Bank of Azad Jammu & Kashmir, has resigned from both his offices as a protest against the non-functioning of the bank in line with the stipulated banking norms, rules and regulations.

Submitting his resignation to the AJK Minister for Finance Ch Latif Akber, who is also Chairman of the Bank of AJK, Mr Abbasi said that for the last two years he had been insisting the AJK govt to mend their ways towards the affairs of the bank of AJ&K since they were trying to run the bank like a govt department with serious irregularities and violations and their handpicked incompetent management.

read more: http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/national/18-Feb-2012/ajk-bank-s-executive-steps-down?utm_source=feedburner&utm_medium=feed&utm_cam paign=Feed%3A+pakistan-news-newspaper-daily-english-online%2F24hours-news+%28The+Nation+%3A+Latest+News%29

Saudi Hollandi Banks MD quits

RIYADH: Saudi Hollandi Banks Managing Director Geoffrey Calvert has resigned for personal reasons, the bank announced yesterday. On accepting his resignation at the board of directors meeting held yesterday in Riyadh , it was decided to appoint Dr. Bernd Van Linder, general manager of the treasury, to be the acting managing director of the bank succeeding Calvert.

Mubarak Abdullah Al-Khafrah, chairman of the board of directors, thanked Calvert for his contributions to the development of the bank during his time as managing director. He wished the new acting manager great success. Linder joined the Saudi Hollandi Bank in 2006. He has 12 years banking experience in ABN Amro in different positions.

read more: http://webcache.googleusercontent.com/search?q=cache:ZVfFZypqVIcJ:www.a1saudiarabia.com/4489-saudi-hollandi-banks-md-quits/+&cd=4&hl=en&ct=clnk&gl=us

Ken Ofori-Atta steps down as Executive Chair of Databank Group

Investment banker, Ken Ofori-Atta has stepped down as the Executive Chair of the Databank Group.

He announced his retirement from the investment bank on Tuesday. This will relive him of the day-to-day administration of the firm even though he will stay on as the ceremonial chair.

Mr. Ofori-Atta and Kelly Gadzekpo set up Databank in 1990 and is one of the leading investment banks not only in Ghana but in the sub region. Kelly Gadzekpo is expected to take over as new Chief Executive of the Group.

Mr. Ofori Atta tells JOY BUSINESS he is forced to step down for health reasons.

read more: http://business.thinkghana.com/pages/finance/201202/57429.php

Slovenia's Two Biggest Banks' CEOs Step Down as Woes Mount

Nova Ljubljanska Banka d.d. and Nova Kreditna Banka Maribor d.d., Slovenia's two largest banks, are without chiefs as they struggle with mounting bad loans.

Andrej Plos, the chief executive officer of Nova Kreditna Banka Maribor, who took the helm of Slovenia 's second-biggest bank in January, offered his resignation today without giving a reason. Bozo Jasovic, the CEO of the larger Nova Ljubljanska Banka d.d. stepped down in December over the bank's attempt to sell the holding in retailer Mercator Poslovni Sistem d.d. to the Croatian rival Agrokor d.d.

"It's actually hard to believe that the biggest lenders are without a proper leadership in such crucial times for the banking sector and as Slovenia sees its credit rating lowered due to a fragile bank system," Saso Stanovnik, head of research at Ljubljana brokerage Alta Invest d.d., said in an e-mail today. "One can only hope the new leaderships are in place as soon as possible to tackle the problems of the banking sector."

Slovenian banks are struggling with mounting losses as the faltering economy pushes more companies into bankruptcy. Lenders in Slovenia , which adopted the euro in 2007, reported 356 million euros ($469 million) of losses last year, the central bank said on Feb. 7.

read more: http://www.bloomberg.com/news/2012-02-15/slovenia-s-nova-kreditna-banka-maribor-ceo-plos-resigns.html

Social finance pioneer Hayday steps down from Charity Bank

Malcolm Hayday, CEO and one of the founders of Charity Bank, has decided to step down from the post this year.

Under Hayday's leadership, Charity Bank has grown from concept to launching as the world's first general registered charity that is also an authorised bank.

This year Charity Bank celebrates its 10th anniversary, with the bank's balance sheet at the end of 2011 exceeding £80m, an increase of almost 20% on the previous year, and many times the opening figure of £6.4m in 2002. It also expects to report a surplus of over £350,000.

read more: http://www.socialenterpriselive.com/section/news/people/20120214/social-finance-pioneer-hayday-steps-down-charity-bank

Two Top Morgan Stanley Bankers Resign

NEW YORK (Reuters) - Morgan Stanley's (NYSE:MWD - news) two top investment bankers resigned on Wednesday, increasing the pressure on Chief Executive Philip Purcell and raising questions about whether the securities firm can remain independent.

The resignations are the biggest blow yet in a battle raging between Purcell and a group of eight former Morgan Stanley executives seeking to oust him.

Joseph Perella, Morgan's investment banking chairman and company vice chairman and one of the best-known bankers on Wall Street, resigned after 12 years at the firm. Tarek "Terry" Abdel-Meguid, a long-time Perella deputy and the head of investment banking, also quit.

The firm quickly named new co-heads of its Investment Banking Division and said Perella and Meguid had agreed to stay on for an unspecified transition period.

"Morgan Stanley simply cannot be managed if this much turmoil exists within," Punk, Ziegel & Co. analyst Dick Bove said. "And if it cannot be effectively managed, I don't see how Purcell can stay at the top."

Morgan Stanley's board responded directly to the dissidents on Wednesday, criticizing their campaign and reaffirming its support for Purcell.

At least 10 traders and bankers have left the firm since Purcell shook up management in the securities business late last month. The departure of Perella is especially painful because of his stature on Wall Street and his recent support for Purcell.

read more: http://www.stockbroker-fraud.com/lawyer-attorney-1133774.html

Key Chavez Minister Resigns Amid Banking Corruption Fallout

By Jeremy Morgan Latin American Herald Tribune staff

By Jeremy Morgan Latin American Herald Tribune staff

CARACAS - President Hugo Chavez lost one of his closest and oldest collaborators as Science and Technology Minister Jesse Chacon submitted his resignation after his brother was arrested in connection with the crisis in which state control has been imposed on six banks.

Arne Chacon was arrested by the state security service, DISIP, after three more banks, Banco Real, Baninvest and Central, were "intervened" by the government, in addition to the four banks - Canarias, Banpro, Bolívar and Confederado - that were first taken over on November 20 on orders from Finance Minister Ali Rodriguez Araque. Two stockbroking houses have been raided by Disip and prosecutors since then, one of which is said also to have been put under direct state control.

Brought before a court, Chacon was ordered to be held in custody pending further investigation of his possible involvement in three banks, reports said. Chacon's brother, the minister, said that when he'd heard the news "I called the president and told him that in these conditions I would prefer to resign so that there would be no doubt about our transparency in this investigation."

read more: http://www.laht.com/article.asp?CategoryId=10717&ArticleId=348565

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Swiss National Bank Chairman Philipp Hildebrand arrives in front of the Swiss National Bank building for a news conference in Bern January 9, 2012. Hildebrand resigned with immediate effect on Monday, relinquishing one of the world's top 10 central banking jobs because he has been unable to prove he was unaware of a $418,000 currency trade made by his wife.

Prosecutor Fabio De Pasquale urged the court to find Mr Berlusconi guilty of having paid a British lawyer 600,000 dollars (£382,000) to lie in other trials involving charges of tax evasion and false accounting related to the billionaire media mogul's business dealings.

Gary Cohn, right, is next in line to replace Lloyd Blankfein, left

Hisashi Mori, the former executive vice president of Olympus , left, and Tsuyoshi Kikukawa, a former chairman and president, were among those arrested

By Jeremy Morgan Latin American Herald Tribune staff

Reply With Quote

Reply With Quote