Regional Banks In Freefall

Regional Banks In Freefall

Just checked gold, saw it went vertical -

Weak JOLTS?, Poor factory orders, a sudden realization of the urgency and seriousness of the debt ceiling debacle, Europe back from vacation, or just pre-FOMC jitters?

Who knows to be frank but everything went just a little bit turbo, starting with a total collapse in regional banks...

And despite the Biden admin claiming that FRC was just another 'outlier' business model, PacWest, Western Alliance, and Zions (among others) are in a freefall...

And despite the Biden admin claiming that FRC was just another 'outlier' business model, PacWest, Western Alliance, and Zions (among others) are in a freefall...

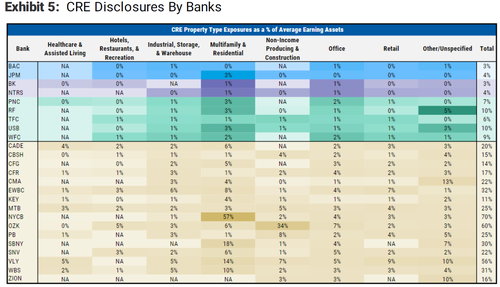

Looks like we are back to "who's next" after yesterday's Milken Conference. Here's a guide...

Looks like we are back to "who's next" after yesterday's Milken Conference. Here's a guide...

But the 'big banks' are also getting slammed...

But the 'big banks' are also getting slammed...

The majors all instantly puked at the US cash open, led by Small Caps (but The Dow and S&P are down over 1%)...

The majors all instantly puked at the US cash open, led by Small Caps (but The Dow and S&P are down over 1%)...

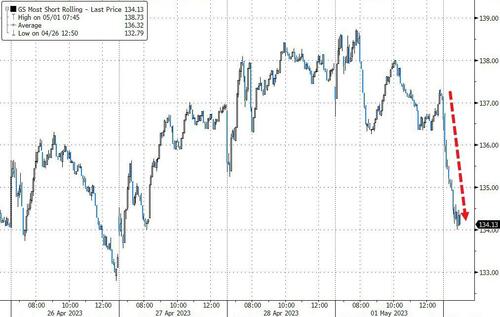

"Most Shorted" stocks are getting monkeyhammered lower...

"Most Shorted" stocks are getting monkeyhammered lower...

Notably, 0-DTE traders are fighting this downtrend hard...

Notably, 0-DTE traders are fighting this downtrend hard...

Source: SpotGamma

Source: SpotGamma

Just as we warned yesterday, the surge in yields (driven by a heavy corporate calendar and illiquid marke) has reversed entirely with yields collapsing this morning...

The 2Y Yield has puked back to a 4.00% handle...

The 2Y Yield has puked back to a 4.00% handle...

Rate-hike expectations are dovishly puking lower...

Rate-hike expectations are dovishly puking lower...

Gold has spiked back above $2000...

Gold has spiked back above $2000...

And Bitcoin is starting to rip again...

And Oil prices are tumbling, with WTI now back well below pre-OPEC+ levels...

Is this a last minute effort to pressure Powell to be 'one and done'?

https://www.zerohedge.com/markets/st...banks-freefall

"The one who says he stays in Him is indebted to walk, even as He walked." 1Jn 2:6

Without Torah, His walk is impossible - it's Rome's walk without Torah.

And despite the Biden admin claiming that FRC was just another 'outlier' business model, PacWest, Western Alliance, and Zions (among others) are in a freefall...

Looks like we are back to "who's next" after yesterday's Milken Conference. Here's a guide...

But the 'big banks' are also getting slammed...

The majors all instantly puked at the US cash open, led by Small Caps (but The Dow and S&P are down over 1%)...

"Most Shorted" stocks are getting monkeyhammered lower...

Notably, 0-DTE traders are fighting this downtrend hard...

Source: SpotGamma

The 2Y Yield has puked back to a 4.00% handle...

Rate-hike expectations are dovishly puking lower...

Gold has spiked back above $2000...

Reply With Quote

Reply With Quote